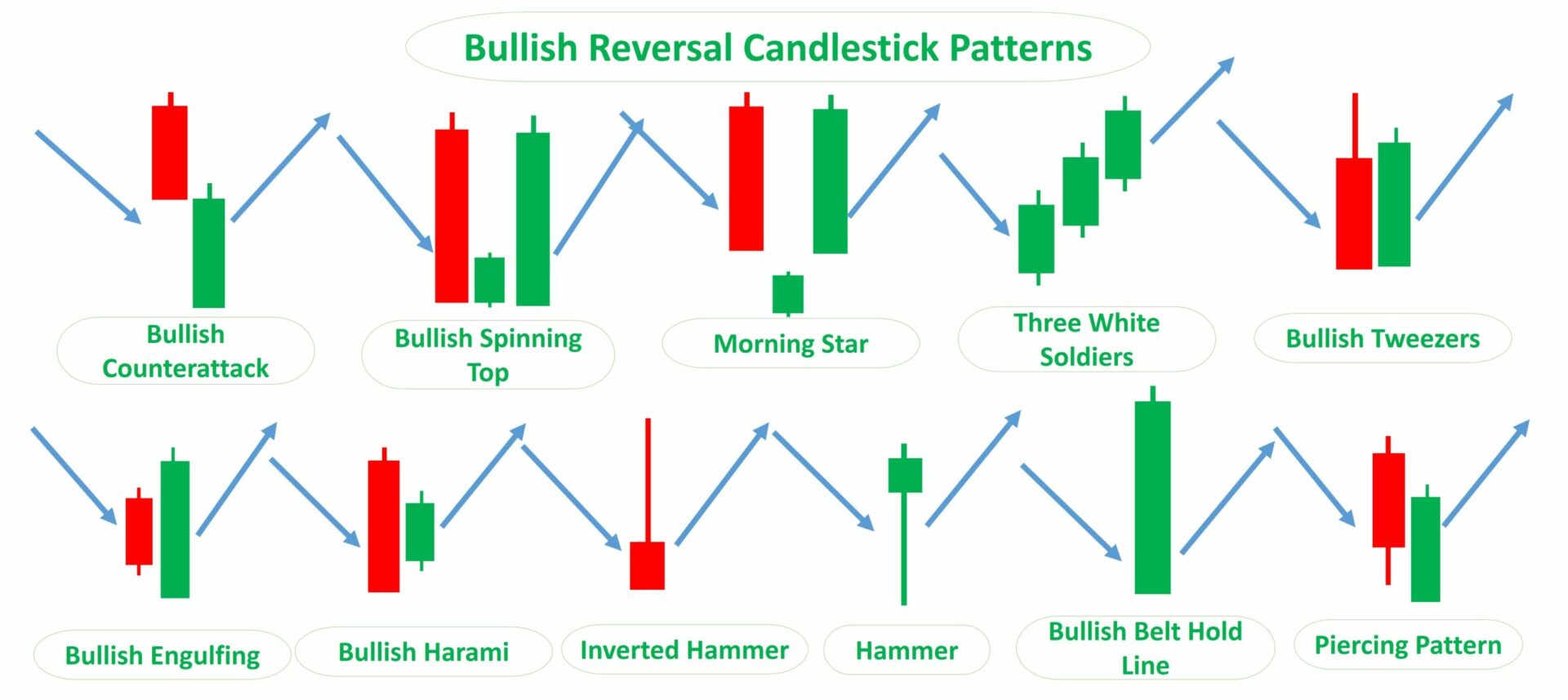

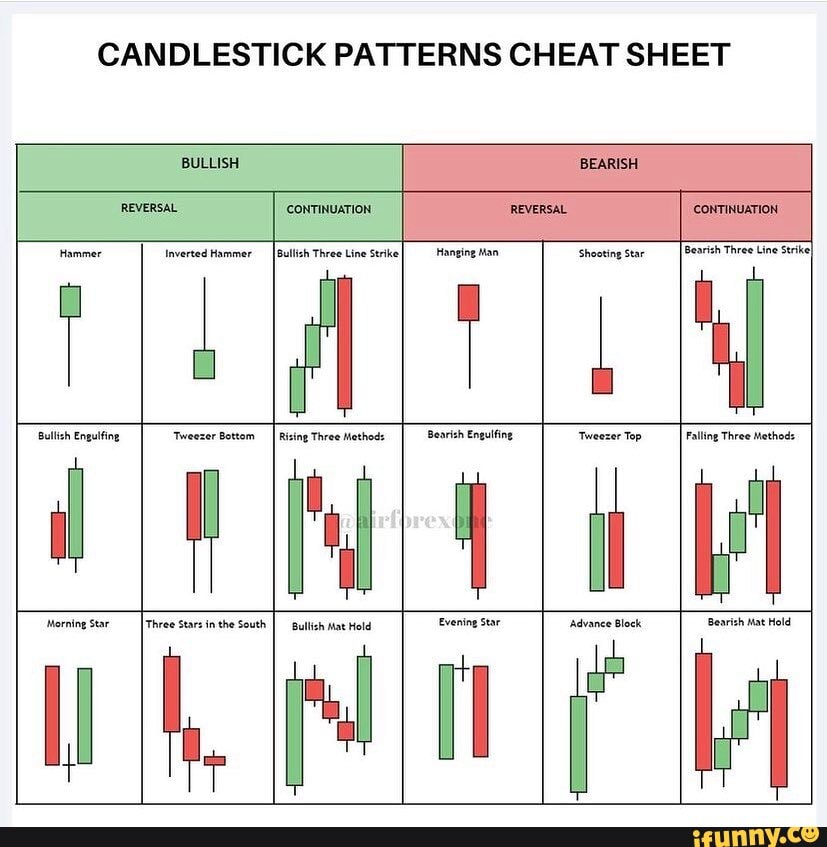

candlestick chart continuation pattern. Continuation patterns help traders to diferentiate between a price action that is in full reversal and those just taking a pause. Bullish engulfing is a multiple candlestick chart pattern that is formed after a downtrend indicating a bullish reversal.

candlestick chart continuation pattern Most traders believe that there is a time to trade and a time to rest. Article shows the top 10 performing continuation candlesticks with links to descriptions and performance statistics, written by. It is formed by two candles, the second candlestick engulfing.

Common Continuation Patterns Include Triangles, Flags, Pennants, And.

Most traders believe that there is a time to trade and a time to rest. Continuation patterns help traders to diferentiate between a price action that is in full reversal and those just taking a pause. Continuation of an uptrend upside tasuki gap.

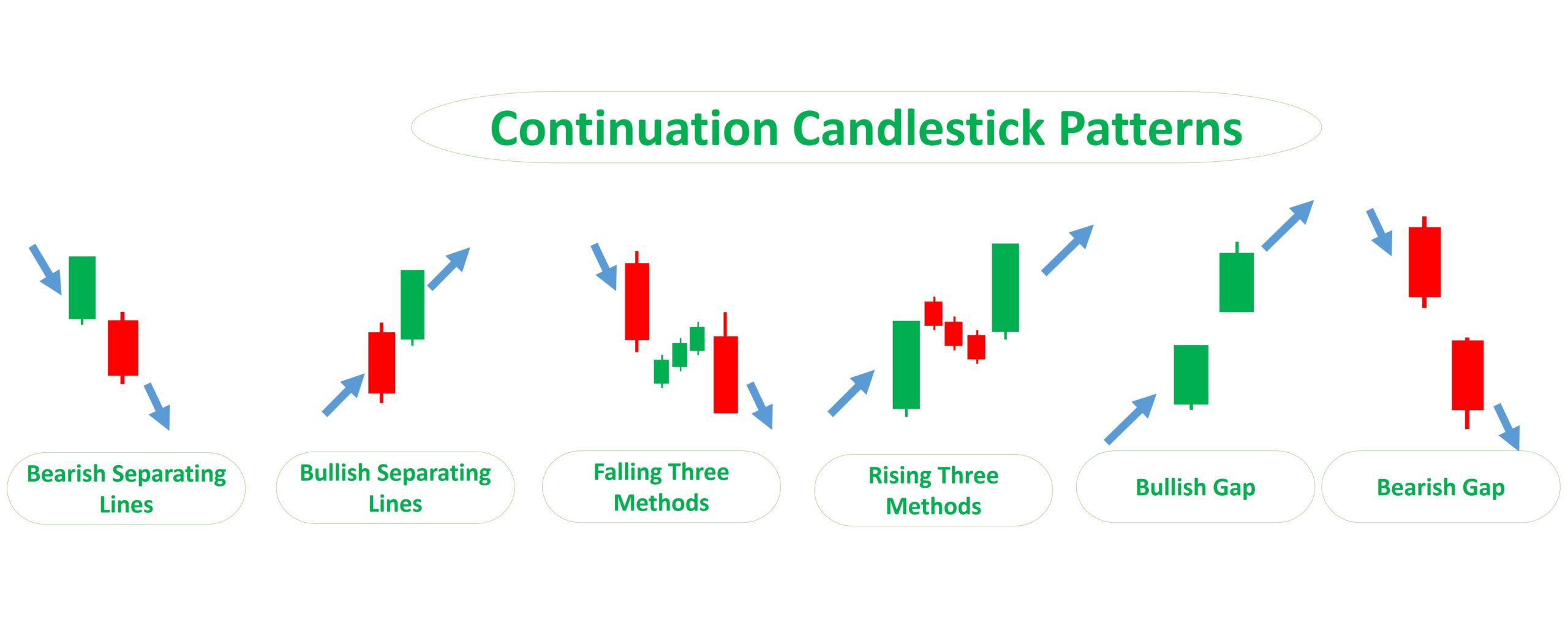

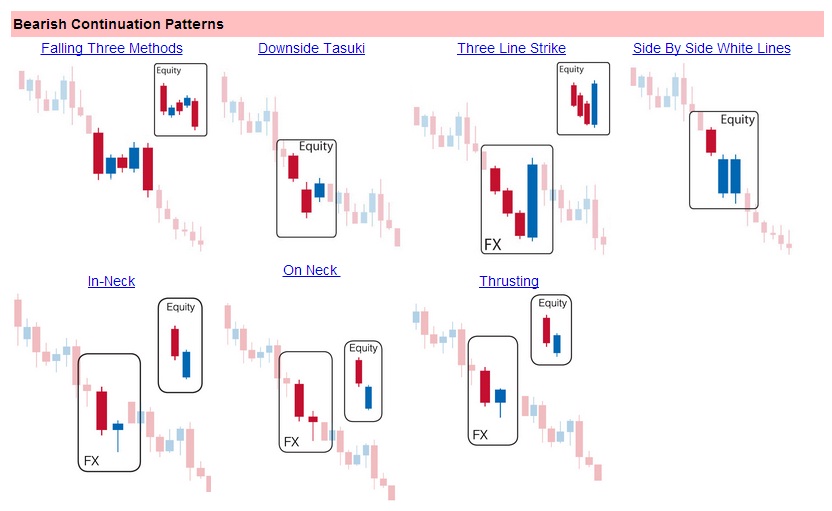

Below You Can Find The Schemes And Explanations Of The Most Common Continuation Candlestick Patterns.

It is formed by two candles, the second candlestick engulfing. Article shows the top 10 performing continuation candlesticks with links to descriptions and performance statistics, written by. Bullish engulfing is a multiple candlestick chart pattern that is formed after a downtrend indicating a bullish reversal.

Continuation Patterns Can Be Seen On All Time Frames, From A Tick Chart To A Daily Or Weekly Chart.

In today’s blog, let us discuss the 7 powerful continuation candlestick patterns: Continuation patterns indicate that the market is momentarily resting as it resets to overcome oversold or overbought conditions.