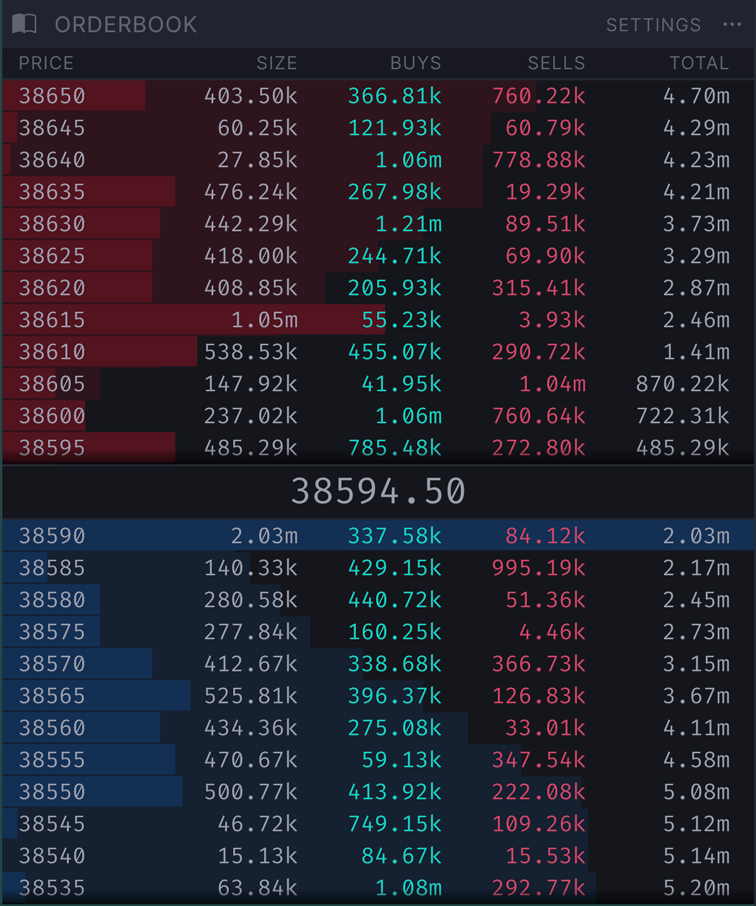

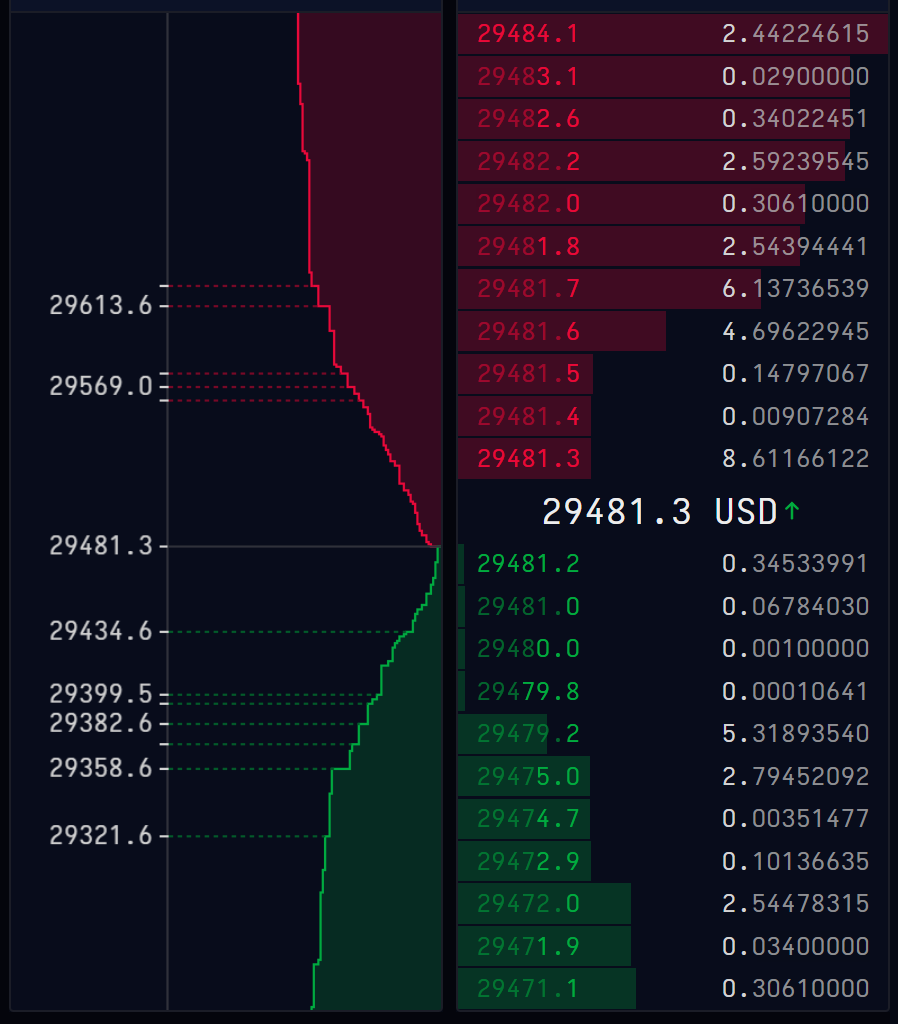

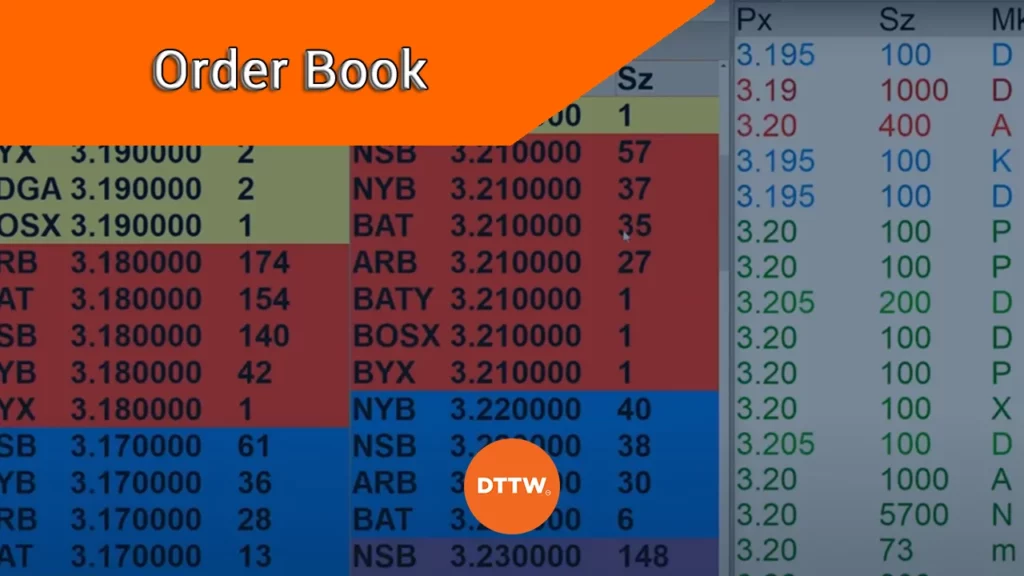

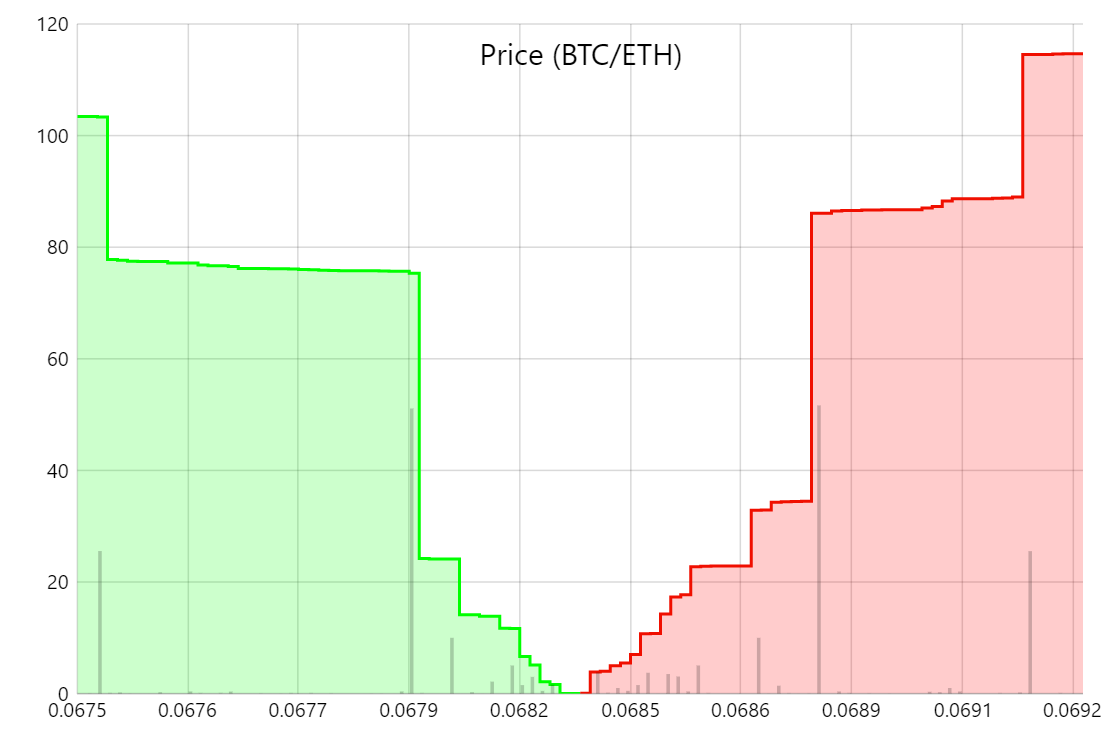

chart order book. Below is a depth of market (dom). Dom comprises of limit orders pendig in the books.

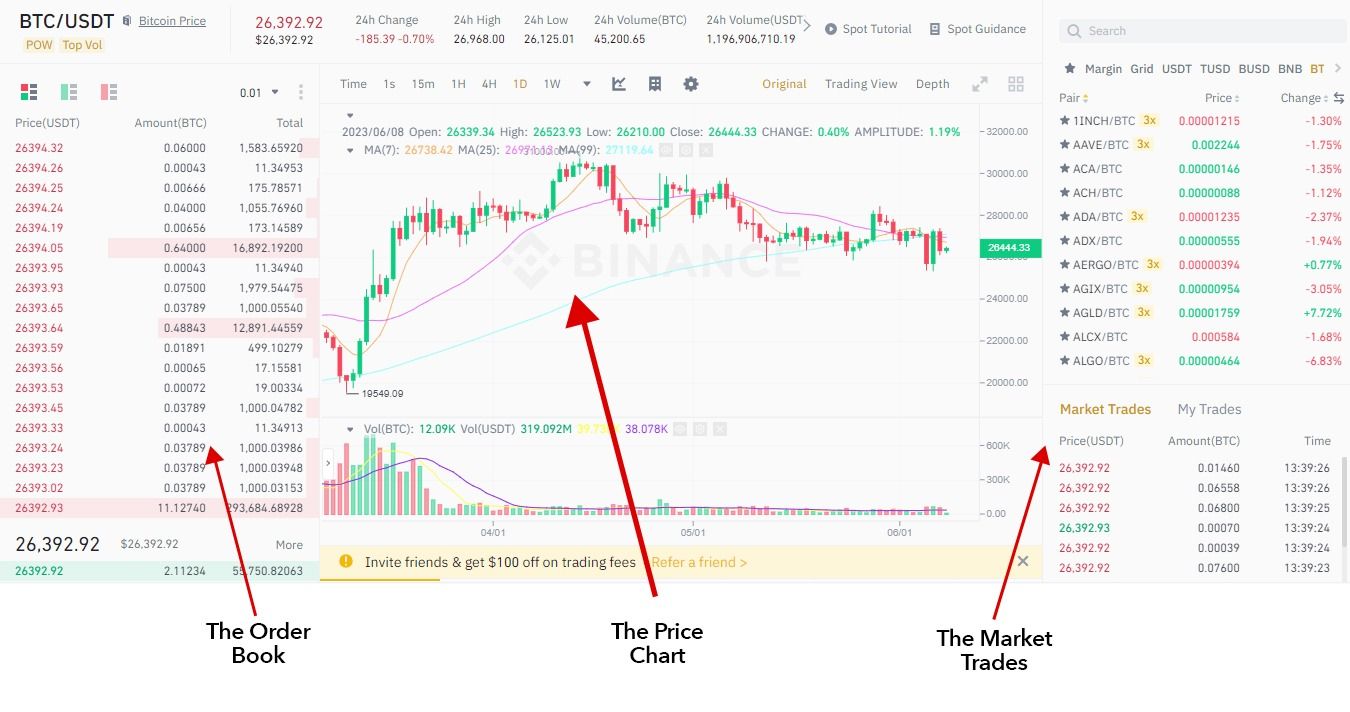

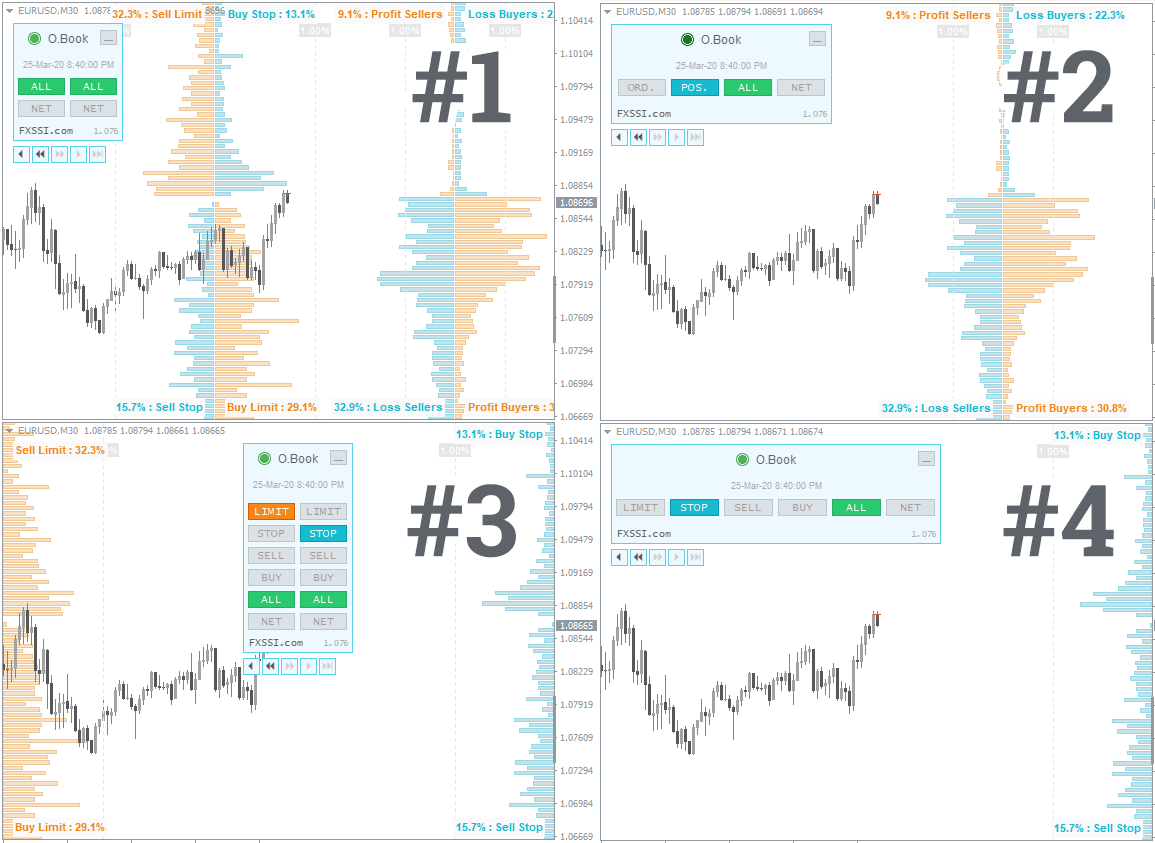

chart order book 3 wk backtest technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue,. Also known as dom or the order book, depth of market is a tool that allows traders to see the number of buys and sells for an asset at. Orderflow is the study of volume.

So What Happens To These Orders In The Trade Cycle.

Below is a depth of market (dom). Dom comprises of limit orders pendig in the books. 3 wk backtest technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue,.

It's Used For Displaying Trading Volume Data In A Way That May.

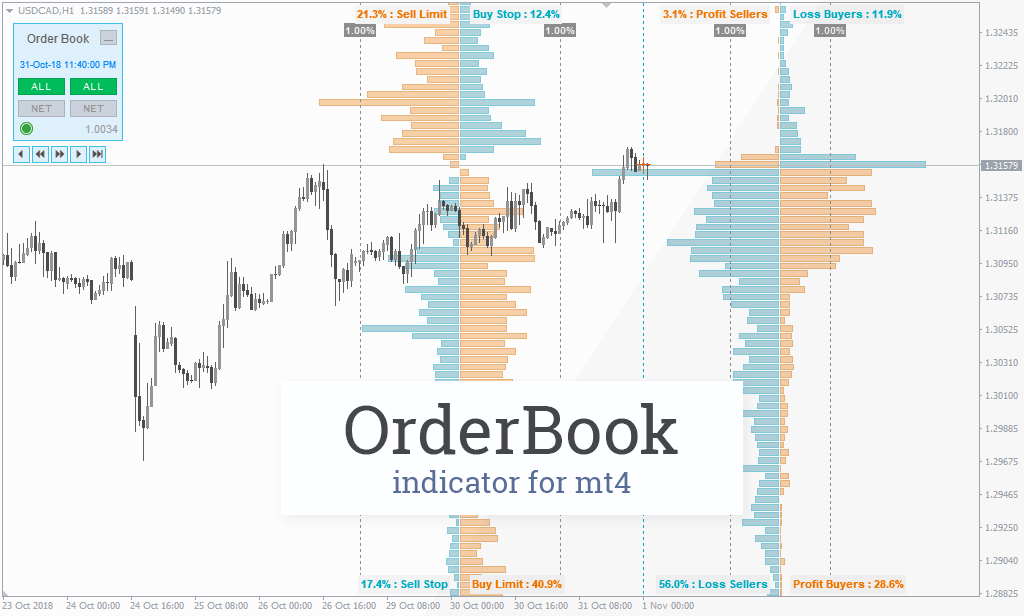

By simply moving your mouse over the chart, you can see the historical formation of the order book. Also known as dom or the order book, depth of market is a tool that allows traders to see the number of buys and sells for an asset at. Orderflow is the study of volume.

The Volume Orderbook Indicator Is A Volume Analysis Tool That Visually Resembles An Order Book.

Tensorcharts order book allows you to see the most important information from it and several order book related tools and settings to. This feature allows you to track how market. Trade with confidence as you watch the market.