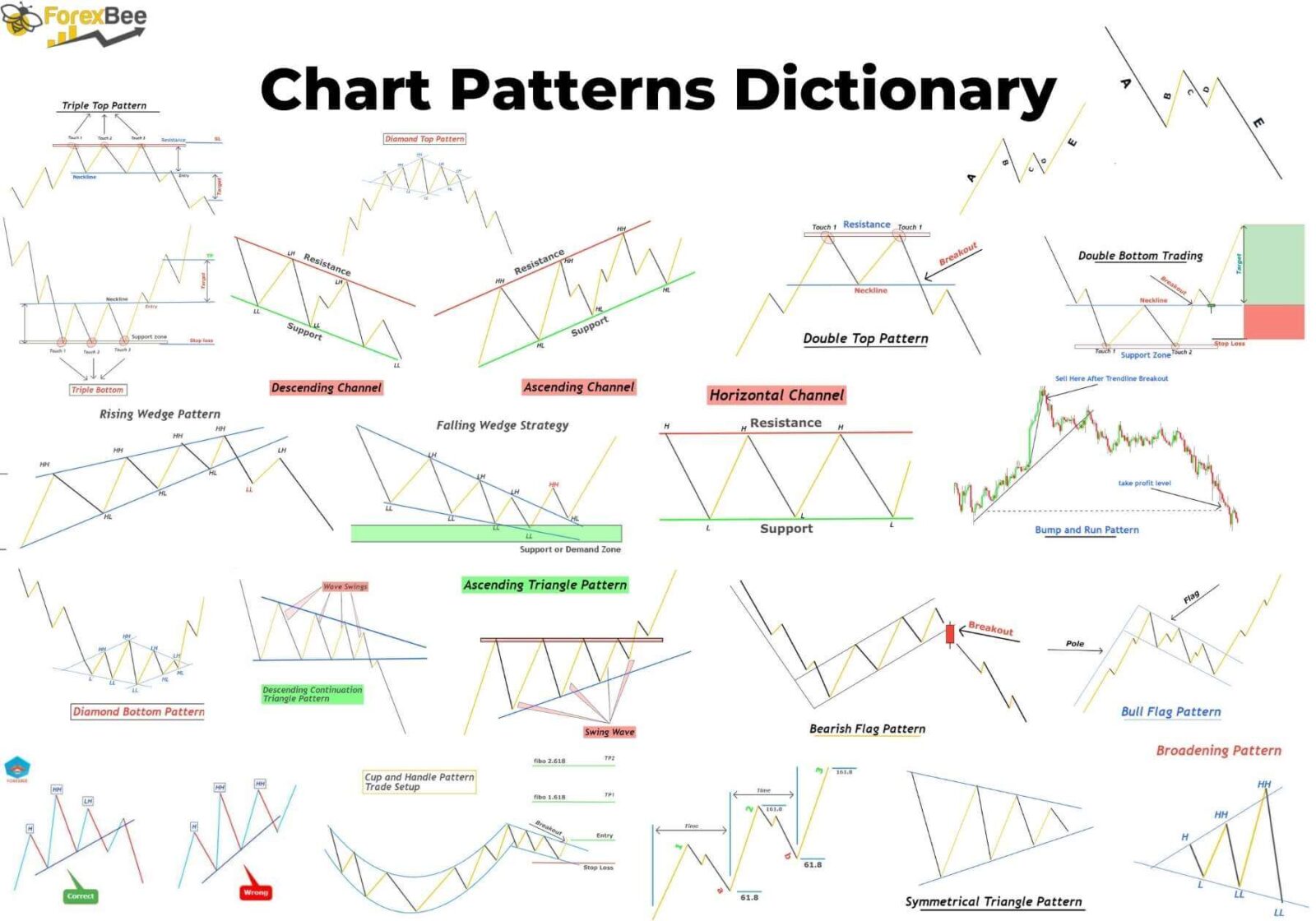

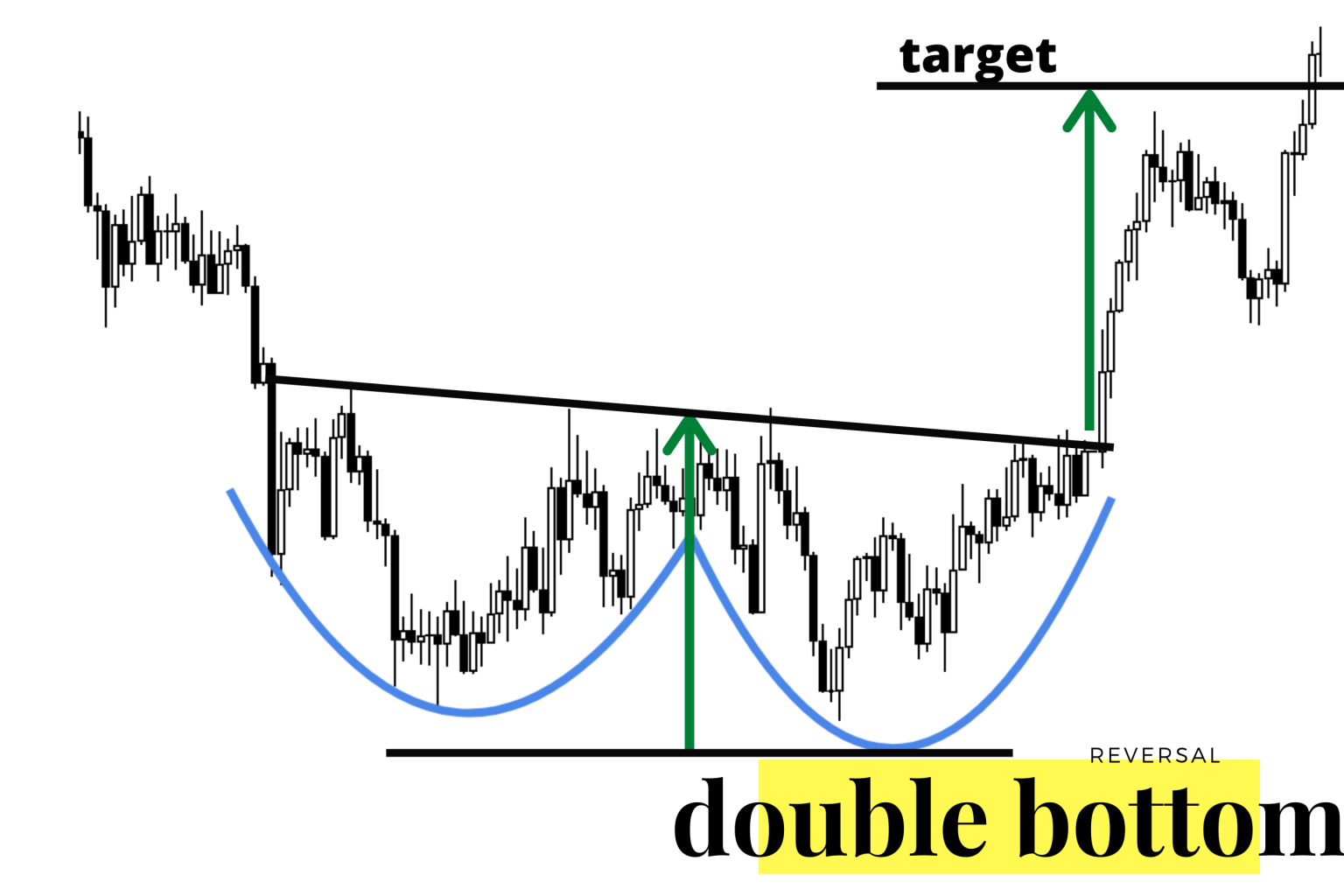

chart w pattern. It’s commonly confused with other patterns. On stock charts, the w pattern can be identified by spotting two low points, representing strong support that the price has been unable to break through, with a peak in between forming the central part of the “w”.

chart w pattern The w pattern, also known as a double bottom, is a bullish reversal pattern that traders use to signal the potential shift from a downtrend to an uptrend. It typically follows the same patterns that can forecast the potential path of a stock’s. W pattern trading is a chart pattern that indicates that the market is potentially shifting from a downtrend to an uptrend.

W Pattern Trading Is A Chart Pattern That Indicates That The Market Is Potentially Shifting From A Downtrend To An Uptrend.

Overview of w bottoms and tops chart patterns. The w pattern, also known as a double bottom, is a bullish reversal pattern that traders use to signal the potential shift from a downtrend to an uptrend. It earns its name from.

It’s Commonly Confused With Other Patterns.

Traders may use w bottoms and tops chart patterns as powerful indicators for buying and selling. The w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. The w pattern in trading, also known as the double bottom pattern, is a bullish reversal chart pattern that typically appears after a prolonged downtrend.

On Stock Charts, The W Pattern Can Be Identified By Spotting Two Low Points, Representing Strong Support That The Price Has Been Unable To Break Through, With A Peak In Between Forming The Central Part Of The “W”.

It typically follows the same patterns that can forecast the potential path of a stock’s. For pattern traders, the w pattern is one of the more bullish chart formations you can find.